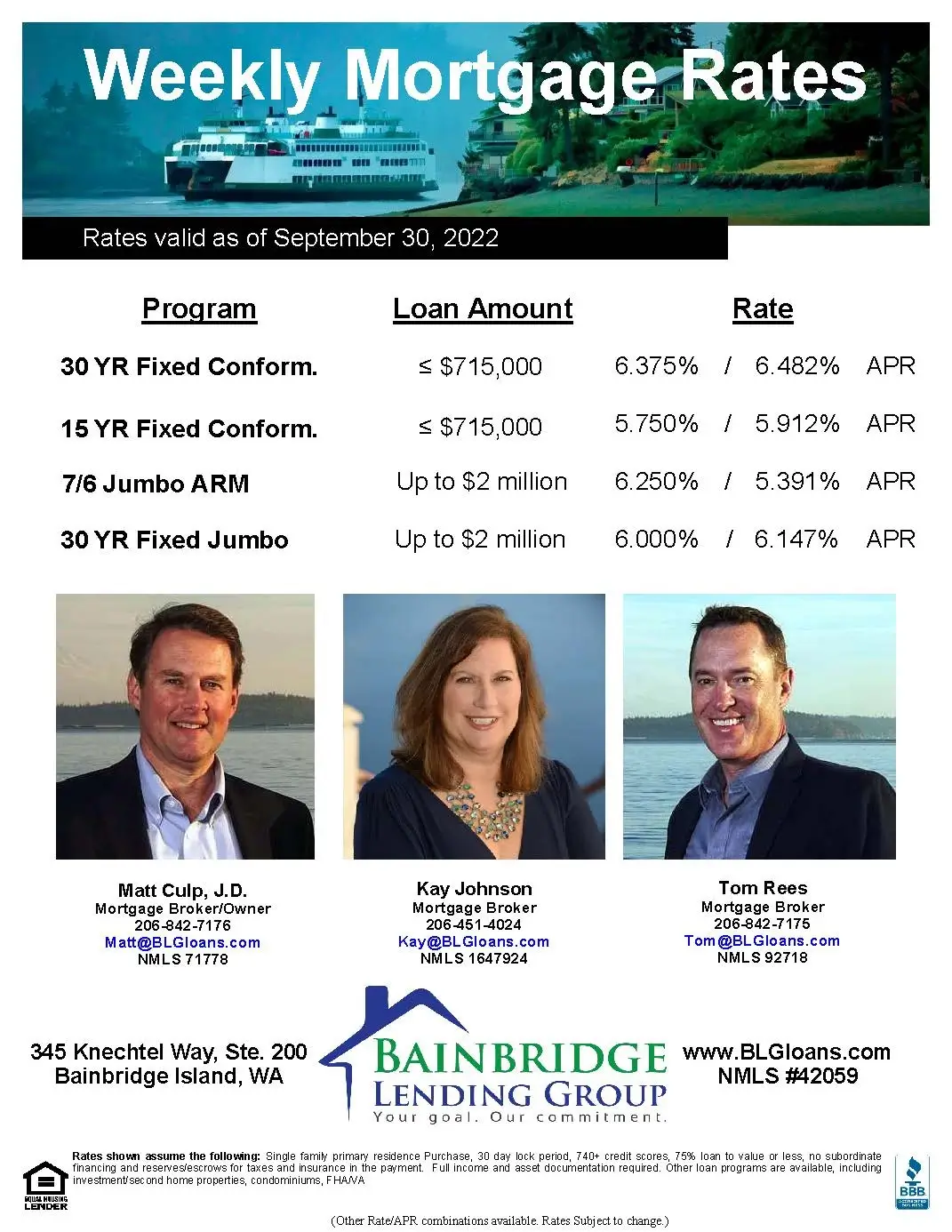

Here are the weekly rates for September 30, 2022:

-

- 30 Year Fixed Conforming: 6.375% (6.482% APR)

- 15 Year Fixed Conforming: 5.750% (5.912% APR)

- 7/6 Jumbo ARM: 6.250% (5.391% APR)

- 30 Year Fixed Jumbo: 6.000% (6.147% APR)

For the rate sheet PDF, click here.

Hi there. Rates ended the week up yet again. The 10 year bond ended at 3.83% up from last week’s 3.69%. It did top 4.0% briefly on Wednesday, the highest in about 15 years. Same for mortgage rates as they jumped again with the Freddie Mac 30 year fixed hitting 6.70% up from 6.29% last Thursday. Attached is our weekly rate sheet. Please pass this along to anyone you know who could use our assistance.

Also attached again is our 2-1 rate temporary buydown flyer. We have had a number of inquiries about this Fannie/Freddie program and how it works. Let us know if you want more info or for us to run a scenario for a buyer or seller. This is a good program to temporally mitigate the high rates with the hope that rates come back down in the next year or so.

Continued fallout from the Fed meeting last week is pushing rates up. Some hotter than expected wage inflation data today also bothered the markets as that metric is closely watched by the Fed. There is no October Fed meeting. Next ones are November and December where another .75% and likely at least another .50%, respectively, are anticipated to be announced. Then maybe the Fed will pause for a bit while they watch the inflation and employment data come in. We can hope!

Finally, we know the “new and improved” NWMLS forms go into effect next week (Forms 41 and 41c) that address buyer agent compensation. We have discussed this with a number of agents and although there may be a bumpy period figuring out the narrative with perspective buyers, we think in the end it will all be worked out in the offer negotiations. At the end of the day a purchase and sale is a math exercise for everyone. We see no issues on the lending side as far as having the buyer pay some or all of their agent’s fee if that is what the contract says. Just another closing cost that is allowable and not really a loan cost, so no RESPA or tolerance concerns. Of course the buyer has to have the funds! That will be something we make sure of when pre-approving buyers going forward. And making sure they have had “the conversation” with their agent and are aware of how it may play out.

We are around all weekend should you or your clients need our assistance. And Go Mariners! Thanks.