With home prices skyrocketing over the past few years, more first-time buyers are enlisting the help of more seasoned homeowners - namely their parents or grandparents - to be co-borrowers with them. In fact, since 2020, the percentage of young adult buye

Nov 29, 2022 | Purchasing a Home

Thanksgiving is a wonderful holiday that gives us the opportunity to express our gratitude to all of our family, friends and clients. All of us at Bainbridge Lending Group, LLC would like to wish you a Happy Thanksgiving and to let you know how much you m

Nov 24, 2022 |

When you are applying for a home loan, you are generally concentrating on the principal and interest charges that will make up your future mortgage payment. However, there is another cost that may be harder to determine at the outset of your loan: your pr

Nov 22, 2022 |

If you are a military member or retired veteran looking to get a mortgage, one of the best available is the VA loan. Sponsored by the Department of Veterans Affairs, these mortgages offer incredible terms to give you a leg up in homeownership. Here are 8

Nov 17, 2022 | VA Loans

Not all homeownership looks like a single-family home with a white picket fence. There are all sorts of property types to help Americans realize the dream of becoming a homeowner. Condominiums, also known as condos, can be the perfect option for those who

Nov 15, 2022 | Purchasing a Home

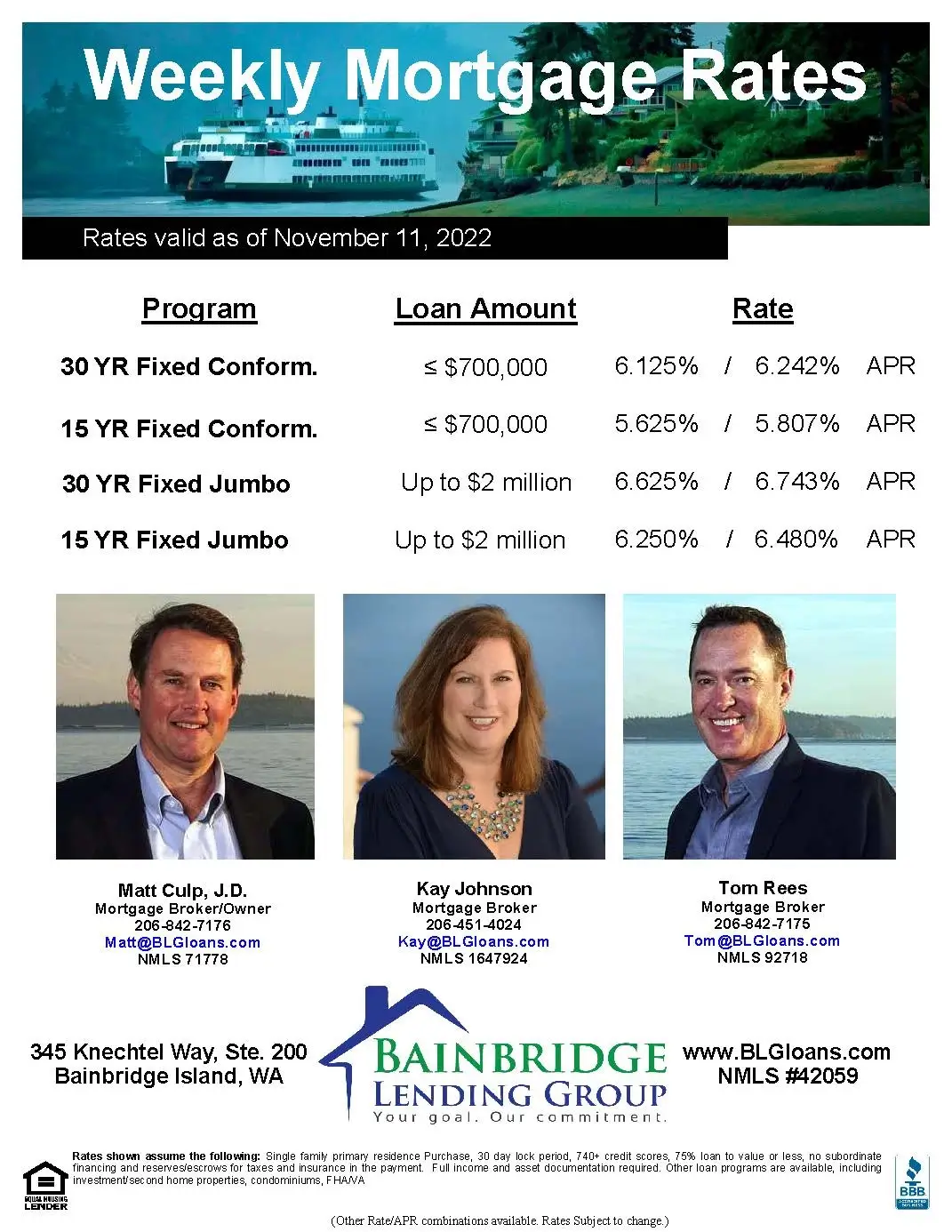

Here are the weekly rates as of November 11, 2022: 30 Year Fixed Conforming: 6.125% (6.242% APR) 15 Year Fixed Conforming: 5.625% (5.807% APR) 30 Year Fixed Jumbo: 6.625% (6.743% APR) 15 Year Fixed Jumbo: 6.250% (6.480% APR) For the rate sheet PDF

Nov 12, 2022 | Interest Rates Fixed Rate Mortgages Mortgage Jumbo Loans